If you live or work in the Netherlands, then you need to possess health insurance. The Dutch healthcare system is ranked among the best in Europe (no matter how many expats living in the Netherlands may have a different opinion on the matter), and it provides quality healthcare to everyone – for every age, medical history, nationality or lifestyle. As long as you have a Dutch residence permit, you get access to medical care. There are many topics to be discussed when it comes to health insurance, but in this article I will aim to provide you information on how the Dutch health insurance is structured and what to look for when you are choosing the best one for you, plus a bit of insight into my own choices. If you don’t have the patience to read the entire article, just skip to the steps that you need to follow in order to make a decision.

How do you get access to health insurance?

The Dutch government is responsible for the quality and accessibility of the healthcare system in the Netherlands, but is not in charge of its management, which is left to the private insurance companies. It is mandatory for every person living or working in the country to have basic coverage for health insurance or apply for healthcare benefits if they don’t have enough income. If you don’t pay for your insurance, you will get a fine, so be sure to choose yours when you move here.

If you are employed, the company you are working for might already have this sorted out for you. Many companies offer a collective insurance plan, and you can opt to be part of it – in which case the employer will choose the health insurance provider. If that is not the case and you are in the position of paying for the health insurance yourself, then you can choose from a good selection of healthcare insurers the one that is the best for you and apply for it directly.

The structure of a health insurance premium:

- Basic package (basisverzekering) — this is the mandatory part of your insurance. If you think you are in good health and don’t expect any medical issues to come up in the following year, you can just make do with the basic package.

- Own risk excess (eigen risico) – this is the amount that you will pay yourself for certain treatments or medication, before the insurance premium takes over and covers the rest. In 2021 the minimum own risk is €385. You can choose to take on a higher risk and then you will get a discount on your insurance.

- Additional insurance (aanvullende verzekering) — this is not mandatory, but every Dutch health insurance company gives you the possibility to choose from a few supplementary plans, which will give you access to services that are not included in the basic package. For example, you can choose to have a few physiotherapy sessions included, or birth control, medical care abroad etc.

- Dental care (tandartsverzekering) — this is not included in the basic package for people over 18 y.o. If you think you might require dental care in the coming year, you can opt for one of the extra plans.

- Other — some companies might have a separate offer that you can choose: for example, one that covers the costs of glasses and contact lenses.

One important thing to know before you start your search is that every health insurance company is required to accept your request for the basic package, but they are entitled to ask you about your medical history and decline the supplementary packages if they choose to. So, don’t be surprised if that happens; just approach another insurer and see if they have different rules in place.

How do you choose your health insurance?

I used to find the system of choosing a company for health insurance quite complicated, especially in my first years in the Netherlands, when I didn’t speak Dutch at all. On first look, the system seems like a tangled mess of overgrown vines that you have to untangle in order to figure out which branches you need. But after a bit of study, it becomes simpler — at least as long as you know what your needs are and what you can expect. All insurance companies have similar offers, and it’s only the price that varies and the medical services included in those extra options. A very important point, before diving into the step by step explanation: read very carefully every detail of the offer before making a choice, so you know exactly what you’re getting, at least for the main coverage, if not for everything. For example, if you don’t pay attention you will end up having an insurance that covers only 75% of your costs, instead of 100%. If that happens, no matter how upset you may become, you won’t be able to do anything about it until the following year when you can change the package.

There are around 60 health insurance companies in the Netherlands. That makes the search process quite hard and lengthy if you want to check out more than three or four. Most people will ask friends and acquaintances for recommendations, but sometimes the experiences are conflicting and you might end up more confused. Theoretically, all companies should be trustworthy and there are laws in place to protect you from potential unfair treatment, so you should be fine with any choice that you make.

I used the Zorgwijzer website for comparing various offers. There are other websites that you can use, but I like this one because it provides the opportunity to check many customer reviews. I also asked friends and acquaintances for recommendations, and I got a list of companies, but I will not restrict my research to that list. This year is the first one when I can choose which company I want to use and I want to have an extensive view over the entire market (just for fun, if not for anything else!). Keep in mind that there is only a limited selection of companies on Zorgwijzer, but for the ones that are missing you can go directly to their websites. Then the tedious work begins: you need to check each company that interests you, one by one.

Steps to follow in order to find the best health insurance policy for you (repeat them for every company that you want to check):

I know it looks complicated because I explained each step in detail, but in reality it should take you only a few minutes to follow these steps for one company (except for the part where you read the terms and conditions document).

Step 1

On the health insurance company’s website, make a simulation to see how much a premium might cost. Usually, you’ll need to fill in your date of birth, as some extra offers are customised based on that. In this step of the process you can add your children, if you have any, or your partner. Children under 18 years of age get the basic insurance without paying an extra fee.

Step 2

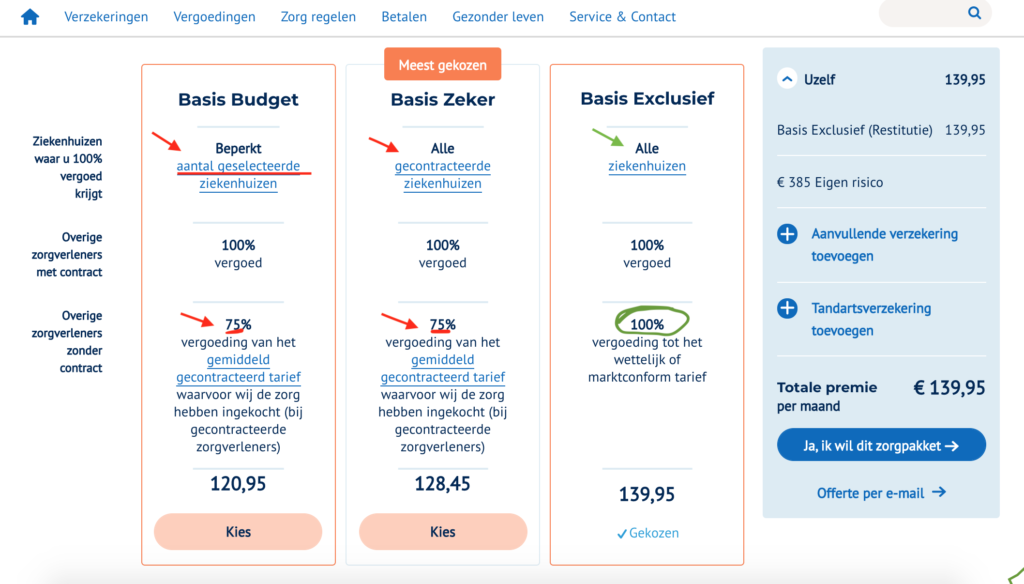

Select the basic package (basisverzekering). This costs around €100 per month and gives you access to consultations with your general practitioner (huisarts), some hospital care, some medication, ambulance services, maternity care, basic mental health services, dental care for under 18 years old – to name only a few. Most companies offer a few versions of the basisverzekering. Be careful which one you choose, as the cheapest ones will cover your costs only for certain hospitals that they have a contract with, or will cover only 75% of the costs (as you can see in the screenshot below). I personally prefer to choose the more expensive version and know that I can go to any hospital in the Netherlands and have my costs fully covered.

Step 3

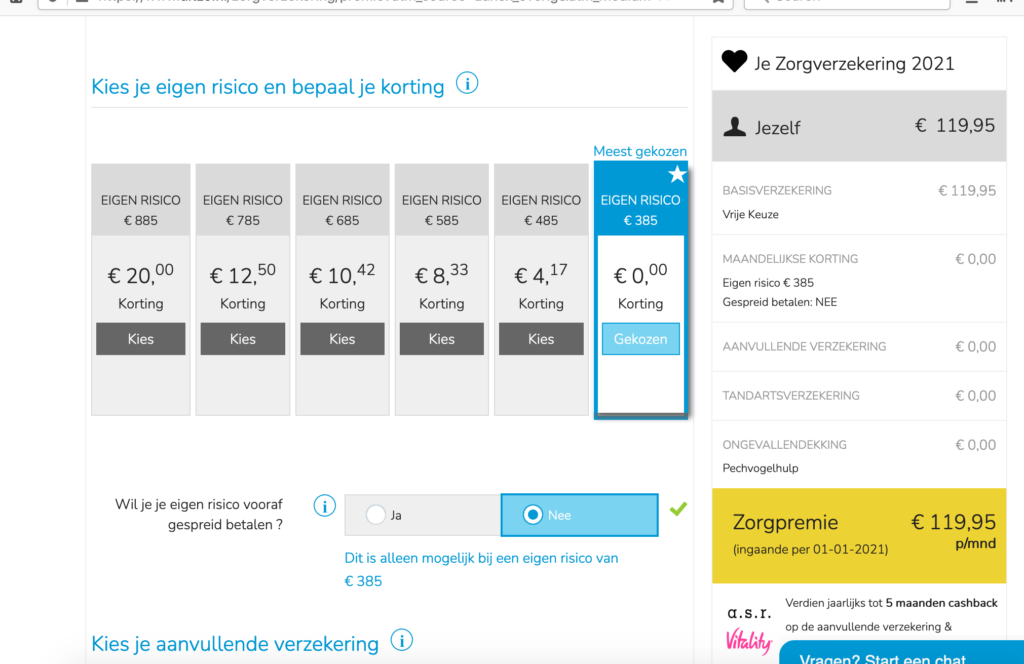

The next step is choosing your own risk or excess fee (eigen risico). You can decide to sign up only for the mandatory sum of €385 (for 2021) or you can choose a higher deductible excess, in which case you get a little discount on your monthly payment. Own risk applies only to certain medical expenses, exceptions being appointments with your huisarts/GP (general practitioner), obstetric and maternity care. This excess fee will be paid only if you actually incur medical expenses; if you only visited your GP twice and required no treatment, then you will not have to pay anything above your monthly premium.

My choice would be to opt for the minimum mandatory sum, because the discount that I would get if I chose otherwise would not be that significant, and I don’t want to find myself paying €600 or €800 out of my own pocket, should I require any medical care next year. But we are all different, you decide what’s best for yourself.

An example on how eigen risico works. Let’s say my medical expenses for 2020 are €1000 and I opted for an own risk of €385. I would have to pay €385 myself, and all the rest up to €1000 (€615) would be covered by the health insurance company. If I would have chosen the own risk to be €685 (bringing me a monthly discount on my premium of €10,42 or €125 for the whole year), I would have paid this amount myself and the insurer would have covered only €315 — a net loss of €175. But, of course, the situation could have been that I would’ve had no extra medical expenses because I’m healthy as a horse and then I would only pay my discounted monthly fee — a net gain of €125.

Step 4

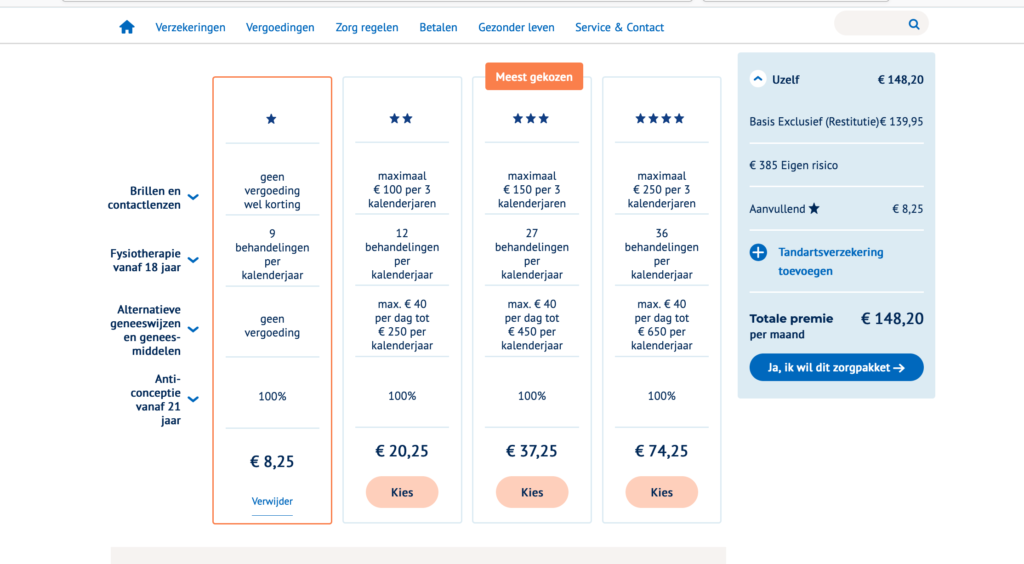

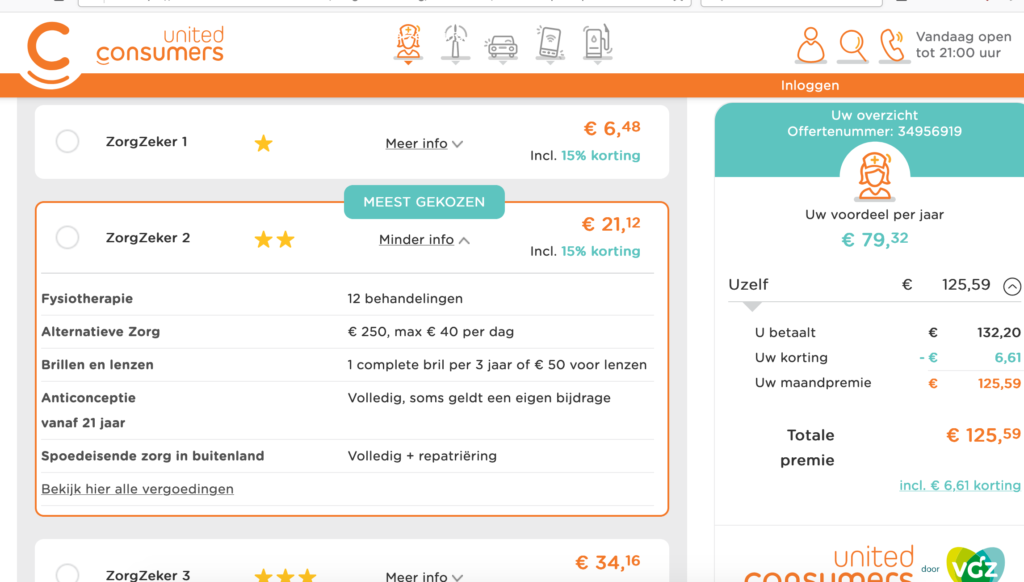

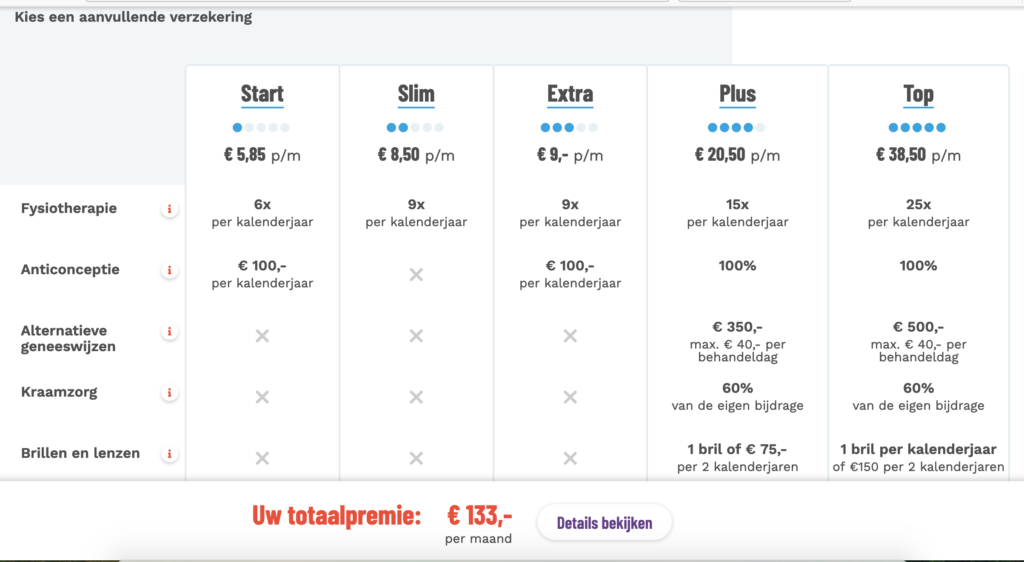

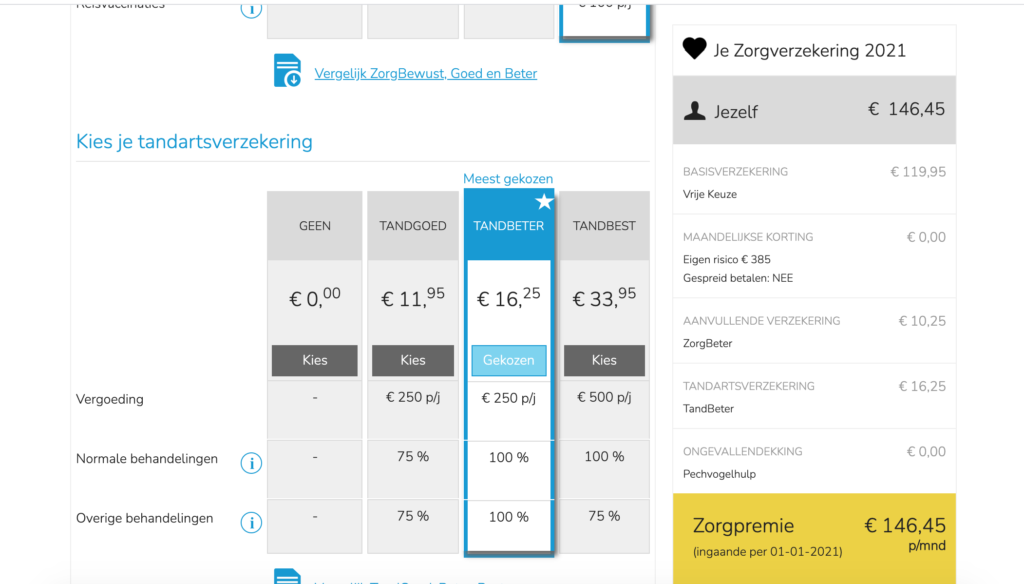

The supplementary insurance (aanvullende verzekering). This is the one that requires most attention. You can choose not to get any extra insurance, for example if you never had to deal with health issues in the past and you expect that you won’t have to in the coming year either. It’s a risk, of course, because we never know when health issues might come up — but it is a risk you can decide to take or not. If you want to pay extra and be insured for more treatments than what is included in the basic package, then you will have to evaluate every option carefully. If money is no issue, and you don’t care how much you pay for your insurance, you can just choose the highest one from a company you trust and you’re done. But if you want to make sure you are getting the best deal for your money, then you’ll have to dedicate a few hours to perform this boring research. When making a comparison, you will see the most important features of each option, like how many physiotherapy sessions are included, birth control or coverage for medical care abroad or glasses. Check out the screenshots below, from three different companies, to see what you can expect:

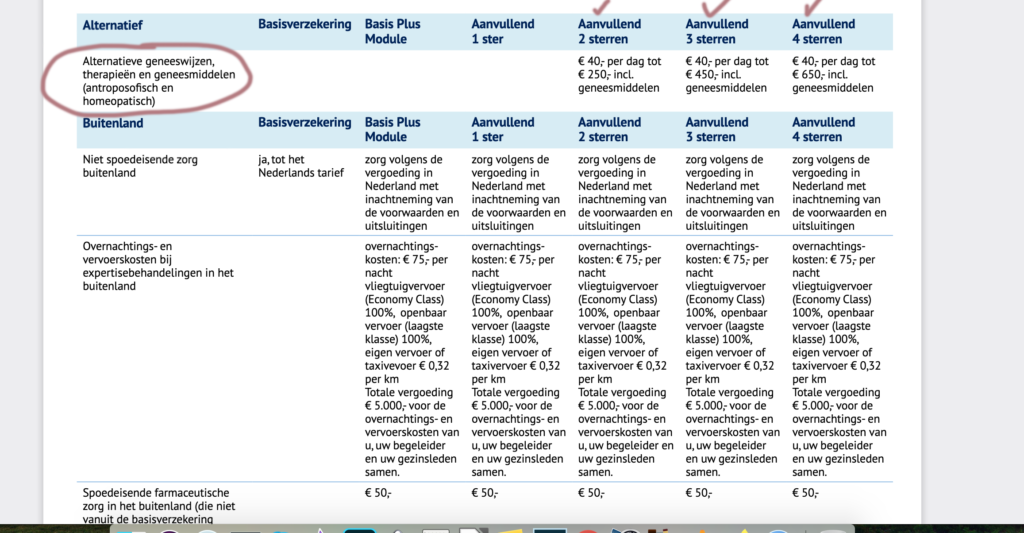

But there is much more to this than just a few features. You will need to find the policy conditions (polisvoorwaarden) on each company’s website and read them carefully, looking for whatever type of healthcare interests you. For example, in the screenshot below you can see that, for this particular company, if you would like to have alternative medicine costs covered, you would need to choose one of the Aanvullend 2 sterren, Aanvullend 3 sterren or Aanvullend 4 sterren options, which will cover a maximum of €250, €450 or €650 respectively.

Most health insurance companies provide information in English on their websites. However, if you want to go into details and read all the policy conditions, you can only find them in Dutch — nothing Google Translate won’t solve, though. I like to read the full policy terms and conditions to be sure that paying extra on my premium is really worth it. For example, if I think that I might use some physiotherapy sessions next year, but maybe only six of them and nothing else from the extra offer, while costing me €20 extra a month to have that covered, I would do a calculation to see how much those six sessions would add up to — I could be better off paying for that from my own pocket when or if the time comes, keeping my premium lower that way.

Step 5

Dental care. The basic package doesn’t include dental care for people over 18 years old, so you need to pay for it separately if you want the coverage. Every company provides a few options, most of them covering up to €250 or €500, with some companies giving you the option to go up to €750 or €1000 (but in that case they might ask for a letter from your dentist stating you have reasons to claim that kind of insurance).

Step 6

Have a look at that extra offer that some companies might have for you, and then you are all done with the research! After you have compared the prices and the offers, it’s time to choose one and submit your request. You will need to provide the information that is required (usually, your BSN, your passport and maybe a copy of your employment contract) and then just wait for it to be processed.

Things to keep in mind when choosing your health insurance

1. The Dutch health insurance can be changed only once a year, in December. Make sure you make your choice before 31 December and apply for it. If you didn’t have any insurance before and you apply for it for the first time, you can do it at any time of the year.

2. Your children up to 18 years old are insured without an extra fee if you add them to your account.

3. If you are a student, especially when you live in the Netherlands temporarily, you are not required to possess Dutch health insurance. In that case, you will need to have either an EU Health Insurance Card or some form of private insurance from your country of origin. You can, if you want, get Dutch health insurance instead, and there are even discounts for students.

4. If you have a low income and you can’t afford to pay for the health insurance, you might be eligible for a healthcare allowance that will cover your premium.

5. Instead of paying for your insurance monthly, you can choose to pay it in full or for half of the year in advance, in order to get an extra discount.

6. Don’t forget to check the hospital or costs coverage of your basic package. If you want to be insured for treatments in all the hospitals in the country and to have your costs covered 100%, you will need to choose the more expensive version of the basic insurance.

7. Make sure to register with a GP (huisarts), because that’s your point of contact with the entire health system. In the Netherlands you can only go to specialists if you have a referral from your GP.

8. There are no special health insurance options for expats, but there might be some companies that are known to offer a more expat friendly experience (website/communication in English, etc.).

Extra resources:

You can read more general information over the Dutch healthcare system on Expatica, the Government website or the Zorginstituut.

I hope this article was helpful and let me know in a comment if you have any tips&tricks or experiences regarding this subject that you would like to share!

Disclaimer: this is not a sponsored post. Any health insurance brand that might appear here is only for illustrative purposes.

—————————————————————–

Stay tuned for more and follow Amsterdamian on Instagram and Facebook for daily stories about life in the Netherlands. Please share this post if you liked it!

Check out my photo book: Amsterdam Through the Seasons!

Trackbacks/Pingbacks